Interim Management Statement: January-September 2021

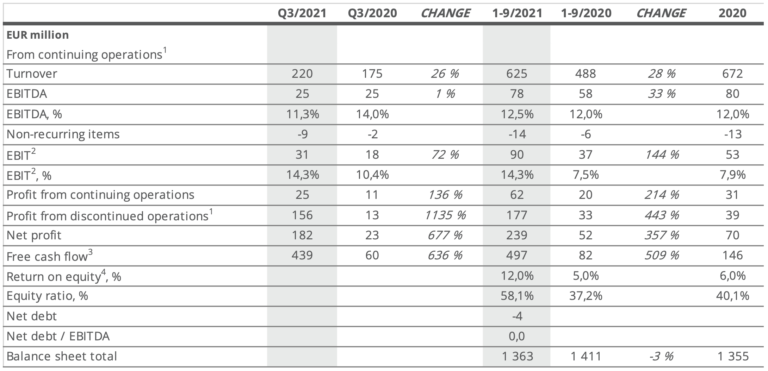

Rettig Group’s strong performance continued in the third quarter of 2021. In January-September 2021 turnover increased by 28 per cent year-on-year to EUR 625 million and consolidated EBITDA increased by 33 per cent year-on-year to EUR 78 million. Rettig Group announced two significant transactions during the third quarter of 2021; the divestment of Nordkalk including a re-investment into SigmaRoc, the buyer of Nordkalk, and the contemplated listing of Purmo Group through a merger with Virala Acquisition Company. The Nordkalk transaction was closed on 31 August 2021 and the closing of the Purmo Group transaction is expected at year-end 2021. Earlier during the year, Rettig Group announced and completed the sale of its shares in Alandia.

1) Nordkalk was divested on 31 August 2021 and reclassified as asset held for sale. The net profit from Nordkalk and the reported sales profit are reported separately as profit from discontinued operations. Thus all other lines in the income statement, including 2020 numbers, are excluding Nordkalk. The reclassification was made as of January 2020. 2) The definition of EBIT has been changed as of 2021 in terms of gain or loss from financial investments which has been moved to EBIT from financial items. The impact of this change has been restated in the 2020 numbers and was EUR 1.1 million in 7-9/2020, EUR 0.9 million in 1-9/2020 and EUR 5.6 million in 2020. 3) Including divestment of Alandia shares in June 2021 and Nordkalk shares in August 2021. 4) Calculated on the profit from continuing operations.

Financial highlights

• Rettig Group’s turnover in January-September 2021 improved by 28 per cent to EUR 625 million (488) thanks to the strong underlying demand for Purmo Group’s products.

• EBITDA grew by 33 per cent to EUR 78 million (58) supported by the overall strong demand and benefits from the successful structural improvement programme in Purmo Group.

• EBIT improved by 145 per cent to EUR 90 million (37) additionally supported by strong continued financial investments performance.

• Free cash flow was EUR 497 million during the review period (82). This reflects solid operative cash flow as well as disposal proceeds from Alandia and Nordkalk.

• By the end of September 2021 net debt / EBITDA was reduced to approximately zero as all senior loans and part of the outstanding commercial paper loans were repaid following the receipt of the Nordkalk sale divestment proceeds.

Outlook for 2021

There is stronger evidence of sustained economic recovery in 2021. Pent-up demand and expansionary monetary and fiscal policies are expected to support the recovery further.

Events after the reporting period

Rettig Group announced on 5 October a consent solicitation and bond buyback tender offer relating to its two outstanding bonds. As a result of the consent solicitation process and tender offer for the EUR 90 million notes due 2023, approximately EUR 85 million was tendered by note holders, and for the EUR 110 million notes due 25 April 2022, approximately EUR 75.5 million was tendered by noteholders. The tender offer was settled on 22 October 2021 and all notes purchased by Rettig Group were cancelled. The notes not tendered pursuant to the tender offer remain outstanding with revised terms and conditions.

Rettig Group will publish its Annual Report for 2021, including its full year financial result, in March 2022.

Further information:

Matts Rosenberg, CEO, Rettig Group: Tel. +358 40 745 5276

Rettig Group is a family-owned investment company that creates value for generations. Our investment strategy focuses on both listed and private assets, and sets out to generate attractive over-the-cycle returns while maintaining an appropriate risk level in the portfolio. A cornerstone in our investment strategy is the ambition to cooperate with professional and like-minded partners and co-investors. Rettig Group is controlled by the 9th generation of the von Rettig family. www.rettig.fi

This is a summary of Rettig Group’s Interim Management Statement for the period from 1 January to 30 September 2021. Unless otherwise stated, the figures refer to 1 January to 30 September 2021 and the corresponding period last year. All figures are unaudited and according to International Financial Reporting Standards (IFRS). The complete Interim Management Statement is available on www.rettig.fi.